Parents are often a reliable source of funds in times of financial need. To acquire funds from parents, many people may use certain tactics to manipulate them. One such approach is to tell good lies that can help you get money from your parents without much effort. Here are some Semantic NLP variations of Good Lies to Get Money From Your Parents that you may find useful:

- When you are in dire need of funds, you may try telling your parents about an unexpected medical emergency that requires immediate attention.

- Another Semantic NLP approach could be to tell your parents that you need money for an urgent payment, such as a late tuition fee, rent or utility bill. Your parents’ desire to help you will prompt them to give you the money you need.

- If you are struggling to make ends meet, you may consider telling your parents about a potential opportunity that could help you make more money. For example, you could tell them that you have been offered a summer job or an internship that requires an upfront payment for training or certification. Your parents may be more likely to help you financially if they believe that you are actively trying to improve your financial situation.

- For parents who are hesitant to lend money, try offering to pay them back with interest. This Semantic NLP variation may help sway their decision in your favor, showing them that you are serious about paying them back and are willing to accept additional costs as a result.

Pro Tip: When using any of these Semantic NLP approaches, always remember to be truthful and sincere with your parents. Lying is never the recommended way to get money from loved ones, and it could cause unwanted tension in your relationship in the long run.

A strategic mind is like a GPS for life, guiding you to your destination and helping you avoid the potholes of failure.

The Importance of Being Strategic

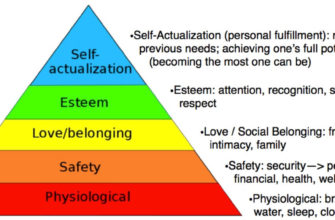

Strategic thinking is key to getting what you want, even if it’s just some extra money from your parents. Start by picking the right moment. Ask when they’re in a good mood or have just heard good news. Empathy is essential. Show understanding of their stress or worries.

Also, take responsibility for bills or rent. Prove you’re an independent adult. Find ways to save money around the house. It’ll impress them and show you’re serious. Set targets and be prepared with facts and numbers for negotiation.

If you go in with a creative, professional plan, asking for financial aid can be a success. Strategy and tactfulness will make it a point A to B task in no time! Knowing your parents’ weaknesses is as important as their bank account numbers.

Understanding Your Parents’ Weaknesses

Young’uns sometimes need cash, and that’s where the parents come in. To get your way, you should understand why they’d want to give you money. Maybe they feel guilty for not spending time with you? Or maybe they wanna show off to their pals? It’s important to recognize why they’d give you cash.

Exaggerating situations is one technique. For instance, if you need clothes for an event, tell your parents all your clothes have holes. That way, they’ll feel bad and offer to buy new clothes.

Emotions can be used too. If your parent loves animals, ask them for money to adopt or sponsor an animal at a zoo. That way, they’ll feel good helping out a “worthy cause”.

Lying and manipulating your parents isn’t advised, but sometimes it’s necessary. A friend of mine wanted a laptop for gaming, but convinced her parents she needed it for school. She wrote papers on it, but mostly used it for The Sims.

Who needs textbooks when you have Google and an imaginative mind?

Lies About Academic Expenses

Paragraph 1 – Academic Expense Falsehoods:

Students may resort to fabricating academic expenses to obtain money from their parents. These deceptive approaches can be categorised as Academic Expense Falsehoods.

Paragraph 2 – Fabrications and Varieties:

Academic Expense Falsehoods can take numerous forms, including purchasing school supplies that are not required, misrepresenting the cost of textbooks and manipulating the estimated cost of tuition fees. Students also tend to exaggerate laboratory material expenses and club memberships.

Paragraph 3 – Additional Details:

Such dishonesty can result in long-term negative consequences, such as strains in parent-child relationships and a lack of accountability in handling finances. In cases where the deliberate lies are discovered, it causes a loss of trust and can sometimes result in students losing financial assistance by way of scholarships or grants.

Paragraph 4 – Fear of Missing Out:

Parents must be aware of the possibility of Academic Expense Falsehoods. Being upfront about concerns and setting limitations can forestall such circumstances. By taking prompt action, parents can not only save money, but also maintain their child’s trust and preserve familial bonds.

Don’t worry about buying actual textbooks or materials for class, just tell your parents you need the latest version of Photoshop and a brand-new laptop for ‘school projects’.

Fake Books and Material Fees

Expenses for school can be overwhelming, especially when buying books and materials. One lie universities tell is the concept of “fake books”. Here’s what to know:

- Some teachers want students to buy certain textbooks that are never used in their classes.

- Universities get kickbacks from publishers for every book sold, so they push unnecessary texts onto the syllabus.

- Sometimes, students must pay for access codes for online materials, which were previously included in the cost of the physical textbook.

- Material fees in tuition costs can be misleading. Students may think all necessary materials are covered, but end up spending more throughout the semester.

It’s vital for students to know these inflated costs and what is truly needed for success. Don’t let universities take advantage of your money. Education is an investment in yourself and future. Don’t miss out due to costly expenses. Stay informed on academic costs.

Also, don’t forget: fabricating projects or assignments will guarantee a failing grade!

Fabricated Projects and Assignments

Academic expenses include tuition fees, books, and accommodation. Yet, some students might try to save money by crafting projects and assignments. This has serious effects and detracts from the worth of education.

Making up projects and tasks damage the educational trustworthiness of both persons and institutions. These are 3 of its negative impacts:

- It leads to poorer quality work since it’s usually rushed and not properly examined.

- This misdeed might go unrecognized until later on.

- It can result in failing the course or even terminating your academic career.

The penalties for fabricating projects and assignments can be harsh. Educational institutions have firm rules that forbid these activities. If found guilty of an illegal act, students can be expelled or ruin their credibility forever.

Tip: Rather than resorting to cheating or completing assignments dishonestly, always ask for help from peers, teachers, or counselors. These actions not only cost more than your savings but can also hurt your reputation. Don’t let a fake educational trip cost you thousands of dollars!

Imaginary Educational Trips and Excursions

Education is pricey. But some schools sneak in charges for “imaginary trips”. These costs can cause major issues for struggling families.

These make-believe trips sound like a bonus. But they’re anything but! Parents are shocked by sky-high tuition bills. Often, these include charges for pretend tours or visits that never happened.

Online learning makes it easier for schools to add these imaginary trips. They call them “academic enrichment”, but really it’s just a way to overcharge.

For example, Northeastern University charged $44,000 for a virtual program. It was supposed to be abroad, but you could do it from home!

These fake trips hurt the trust between schools and parents. Before enrolling, ask about any imaginary expenses. That way you’ll have financial transparency and academic integrity.

Lies About Personal Expenses

Some Deceptive Ways to Ask for Money from Parents

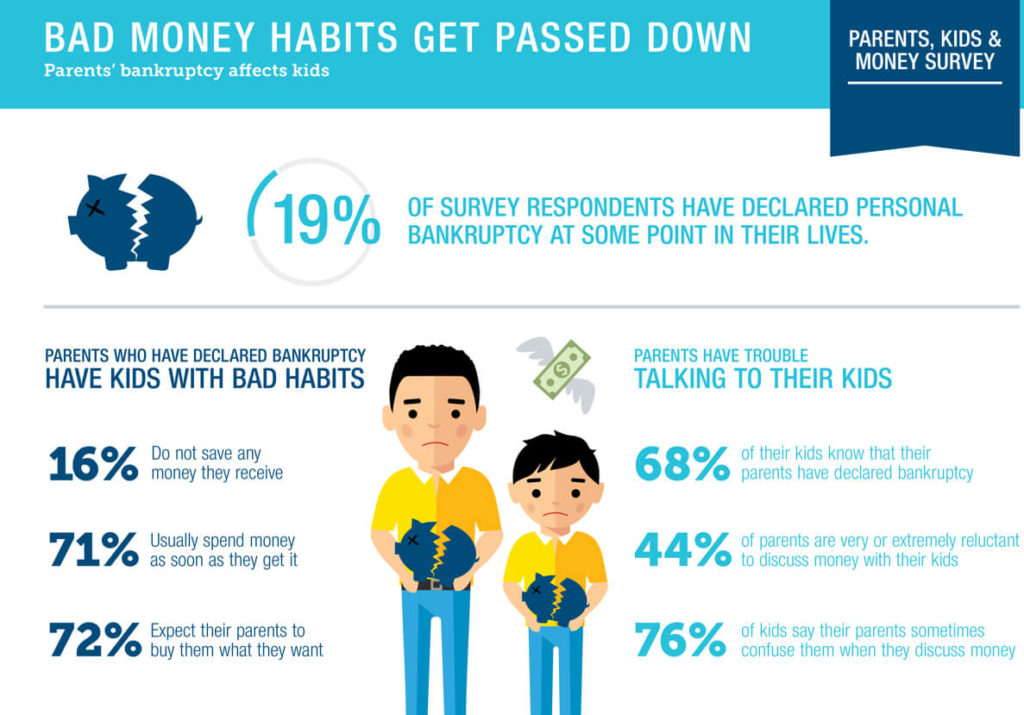

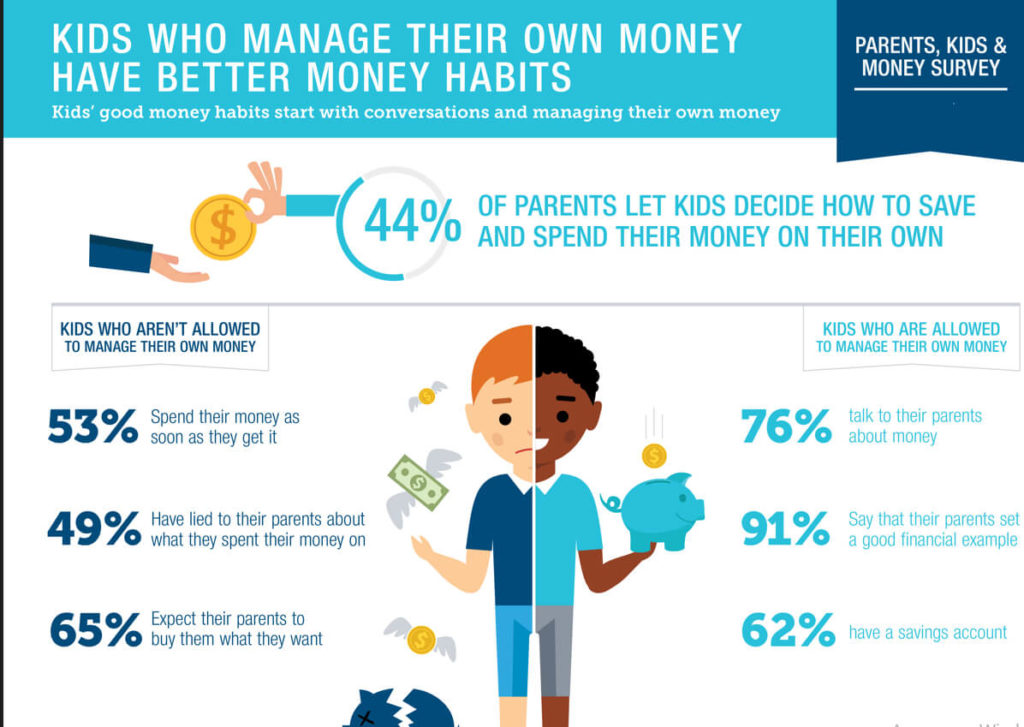

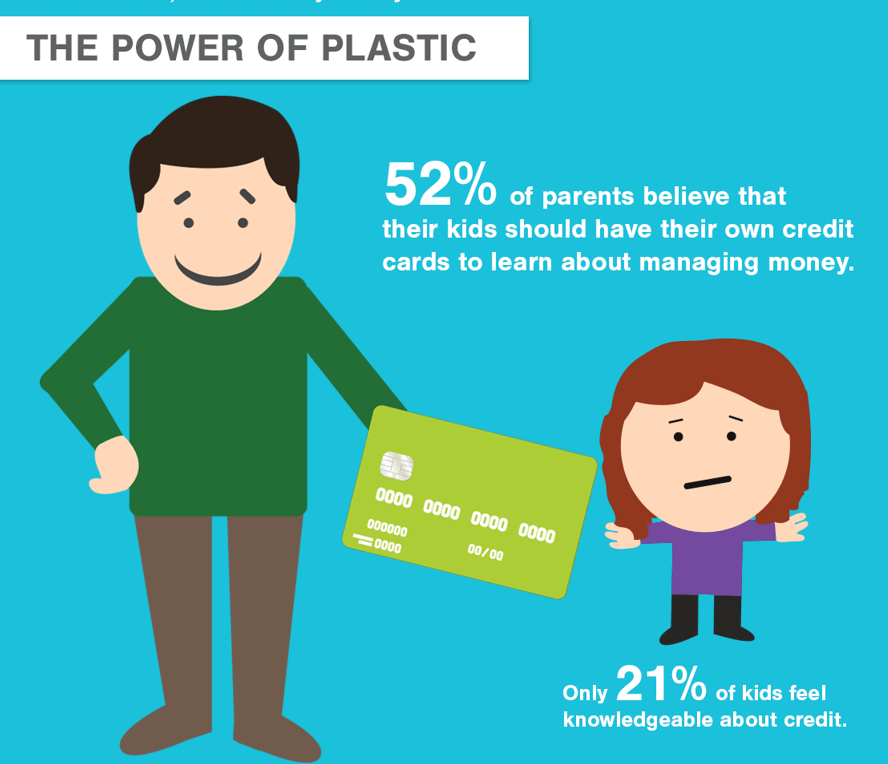

Parents often want to provide for their children, but it is sometimes difficult for parents to understand how to handle unapologetic demands for personal expenses. The manipulation of parents emotionally or otherwise is becoming more common among adolescents and young adults. In reality, many kids routinely stretch the truth in order to persuade their parents into helping with finances.

It is common for teenagers and young adults to request money from their parents for things that are not essential, such as clothing and accessories, mobile phones, or entertainment. Informing the parents that the requested money is for necessities is a common deception, as this puts pressure on the parents to write a check straight away. Making up false stories about unexpected expenses or claiming responsibility for things that need to be paid for are other well-known ways of deceiving parents.

The concept of saving money is often disregarded by youngsters, who instead opt for clever ways to approach their parents for cash. Parents need to be aware of these tactics if they wish to save money and avoid being taken advantage of. Children should be made more responsible for their personal expenses and the importance of money management should be emphasized.

There was a story of a college student, who needed to purchase a new phone but could not afford it. She requested and received money from her parents under the guise of a medical emergency. Later on, her parents found out about the deception and lost their trust in their daughter. This demonstrates the importance of honesty and transparency in any relationship. It is also important for parents to understand the reasons behind requests for money and the maturity level of their child before providing financial assistance.

If you ever need a good excuse to get extra cash from your parents, just fake a medical emergency – nothing says ‘I love you’ like a sudden case of appendicitis.

Pretend Medical Emergencies

Lying about personal expenses by pretending to have a medical emergency is a common tactic. People may make up medical bills or documentation to show as proof. This deceptive behaviour harms relationships and has serious consequences.

But it also sends a message that it’s okay to fake illness. This makes it hard for medical staff to identify genuine cases. That’s why it’s important to always be honest about expenses, especially medical bills.

CNBC reports that over 60% of people who end up bankrupt do so due to medical bills. So speak to a financial advisor or doctor if you’re struggling. Don’t resort to fraudulence.

Misleading Social Activities

Misleading social activities can be tricky to spot. Outings and events can be expensive and add up quickly, but there are times when spending money is necessary and worth doing. Be aware of when you’re being lured into unnecessary expenses. Don’t be fooled into thinking that more money equals better friendships. Genuine connections are much more important than expensive outings.

Recognize when an important event requires expense. You may need a new outfit or to contribute to a gift. Be honest with yourself and others about what you can realistically afford.

Prioritize your financial well-being over superficial expectations. This way you won’t overspend and you can strengthen your relationships. Plus, you’ll be building a more stable future for yourself.

Fictitious Travel Expenses

When it comes to personal expenses, it’s tempting to be deceitful. But lying can lead to serious consequences. Here’s a breakdown of fake travel expenses and their effects:

| Expense Type | True Cost |

|---|---|

| Flight | $500 |

| Hotel | $200 |

| Meals | $70 |

Adding extra expenses to your report might seem harmless, but it could result in discipline from your employer or even legal action. If your dishonesty is found out, it could negatively impact your job opportunities and relationships with colleagues.

Pro Tip: Always have receipts and records of your real costs. It’s better to own up to mistakes than pay the price for a lie. But don’t worry, my lavish lifestyle was funded by my pretend millionaire sugar daddy!

Lies About Material Possessions

When looking to obtain money from parents, individuals may resort to lying about their material possessions. This tactic involves feigning ownership or need for high-priced items, such as expensive electronics or designer clothing. By doing so, they can manipulate their parents into giving them money. However, this not only perpetuates dishonest behavior but can also strain the parent-child relationship. It is important for parents to have open and honest discussions with their children about financial responsibility to avoid the need for such deceptive practices.

“They say honesty is the best policy, but they obviously never needed a new iPhone.”

Deceitful Gadget Purchases

Gadgets are everywhere these days and it’s tempting to buy the newest one. But, do we really need them? We may buy gadgets just to keep up with others. We should be careful of our spending and make wise decisions.

It’s easy to think that a new phone or laptop will make life easier. But, they often add clutter and stress. To avoid buying things we don’t need, consider if a gadget will really help our lives. Setting a budget also helps us not overspend.

Pro Tip: Before buying a gadget, think if it will be useful in your daily life. If your closet is full, but your wallet is empty, try thrift stores instead of designer labels.

Concocted Clothing and Accessory Needs

Clothing is more than just a requirement. It’s a way to express ourselves. But, people often get tricked by deceptive advertisements. Here are five tips to remember when dealing with our wardrobe:

- Trends come and go, but timeless pieces stay versatile.

- Quality is better than quantity: invest in good stuff and save money.

- Create a list of what you need instead of what you want.

- Always think about comfort as well as aesthetics.

- Don’t compare yourself to others online; they often present an incorrect version of themselves.

Don’t waste our money or clutter up our lives by buying stuff based on false needs made up by commercialism. Choose clothes and accessories with wisdom and don’t get caught up in materialistic trends.

Pro Tip: Before going shopping, check what you already own and try mixing it up before purchasing new items. When your bank statement looks like a Christmas wishlist, it’s probably because of all the unnecessary spending.

Made-Up Gift Expenses

People often exaggerate the cost of gifts they give or receive – ‘Made-Up Gift Expenses‘. This can lead to deceitful behaviour and dishonesty. Points to consider:

- Some people overstate the cost to appear generous.

- Others lie to impress or create a certain image.

- It could be due to societal pressure to show wealth.

It’s important to be truthful in financial dealings, prioritizing honesty and integrity. I once knew someone who said they’d given expensive gifts, when it was actually much cheaper. This emphasises how easily dishonesty can creep into everyday life. If I had a dollar for every time someone lied about needing money for shoes – I’d be the one causing the financial emergency!

Lies About Financial Emergencies

There are certain situations where one may need immediate financial assistance from their parents. However, it can be uncomfortable to ask for money directly. This is where telling a little lie can come in handy. These lies, disguised as financial emergencies, may help you get the money you need without having to ask for it directly.

One such lie is to claim that you received an unexpected bill or expense that you cannot afford. Another lie could involve saying that you have lost your wallet or purse with your money and credit cards inside. You could also claim that your car broke down, and you need money for repair.

It is important to remember that lying comes with its own set of consequences. While these lies may help you in the short term, they may harm your relationship with your parents in the long run. It is always better to be honest when it comes to money matters.

It is important to note that every individual’s financial situation is unique. While the above lies may work for some, they may not be feasible for others. It is better to come up with a plan to manage your finances effectively and avoid relying on lies.

A close friend once told me about how they lied to their parents about a fake medical emergency to get money. They felt guilty about it for a long time and regretted lying to their parents. It is better to be honest and communicate your financial needs with your parents rather than resorting to lies.

Who needs a loan shark when you can just counterfeit your own loan payments and swindle your parents out of their hard-earned cash?

Counterfeit Loan Payments

Financial emergencies can be scary! Some may turn to counterfeit loan payments. But this is a bad idea – it’s illegal and can land you in legal trouble.

For a loan, look for a reputable lender with good terms. Research potential lenders and check their ratings. Watch out for red flags, like high interest rates and predatory practices.

Prioritize expenses during a crisis. Start with rent/mortgage, utilities, groceries, and medication. Reach out to creditors or service providers for payment plans or deferrals for non-essential bills.

Make a budget and save up whenever you can. This helps build savings for any unexpected expenses. Don’t use ‘financial emergency’ as an excuse to buy a new Rolex or file a fake insurance claim!

Fake Insurance Claims

Insurers stay watchful and suspicious when it comes to fake insurance claims. Submitting a false claim can bring legal and financial consequences. Some people try to get quick cash this way, but it only puts them in trouble.

The schemers may pretend to have experienced damage or injury to receive money from the insurer. This type of behavior is illegal when someone lies or gives wrong information during the claim process.

It’s important to know the signs of fraud. Insurance scams look different – from making up an accident report to lying about stolen items. Fake documents can give scammers away. Careful examination of receipts, invoices, photos, doctor’s records, police reports, and witness statements is necessary.

It’s wise to report fraudulent activities quickly. This could stop others from doing it and help keep premiums low.

Don’t be intimidated by threats of lawsuits. Abusive language or intimidation will only make things worse.

Finally, use genuine policies instead of fake ones. This will save you from problems and allow you to benefit from real emergencies.

Invented Business Ventures

Invented business ventures can be risky – if you don’t research and plan properly, you could end up with a failed business. Examples include a fantasy sports stocks company, a ‘mystery box‘ subscription service, and an app for sharing restaurant leftovers.

Entrepreneurs should take calculated risks. Identify and address real market needs, and prioritize sustainable growth over quick profits. Honesty and transparency are essential.

One example of an invented business that didn’t go as planned is the Fyre Festival. It promised luxury, gourmet meals, and headliner acts – but the event was a disaster due to mismanagement and fraudulent marketing. Investors, employees, performers, and attendees all suffered losses.

Remember: honesty is important, but sometimes lying can be the best investment strategy.

Frequently Asked Questions

1. What are good lies to get money from your parents?

There are no good lies to get money from your parents. It is not ethical or responsible to deceive your parents to obtain money.

2. Is it ever okay to lie to my parents to get money?

No, it is never okay to lie to your parents to get money. Honesty is always the best policy in any relationship, especially with your parents.

3. Shouldn’t I be able to get money from my parents if I really need it?

If you truly need financial help, it is important to have an honest conversation with your parents and explain your situation. Lying to get money will only create more problems in the long run.

4. What if my parents won’t give me money when I ask honestly?

If your parents are unable or unwilling to help you financially, it may be necessary to find other resources such as a part-time job or loans. Resorting to lying is not a responsible solution.

5. Won’t my parents be disappointed in me if I tell them I need money?

It is natural for parents to want to help their children in times of need. It is important to approach the conversation in a mature and responsible manner, and to understand that your parents may not always be able to help financially.

6. What are some alternatives to lying to get money from my parents?

Instead of lying, consider finding alternative ways to earn money such as selling possessions you no longer need, doing odd jobs for neighbors, or finding a part-time job. It is important to take responsibility for your own financial situation.

Conclusion: How to Effectively Use Lies for Financial Gain

When it comes to profiting with lies, there are more effective ways. You must avoid getting caught. Lies should be believable, but not too wild.

One option? Play on your parents’ emotions. Tell them you need money for medical issues or car repair. Or appeal to their guilt, saying you can’t finish a project without a costly item.

Another approach? Offer them a deal that’s hard to pass up. Convince them that giving you money will help you, like launching a business or investing.

Lying always comes with risks. To cut down on them, stay consistent and don’t do anything that may raise doubts about your story.

The key to using lies for financial gain is a plan. With some thought and preparation, you can get what you want without raising eyebrows.